Interest rate increases have sparked numerous questions among experts and the general public. The growing interest in macroeconomic variables is not just a trend but a necessity. Understanding macroeconomics is crucial and empowers us to make informed decisions and navigate the economic landscape more effectively. Whether we are aware of it or not, this understanding is directly linked to our lives. In recent years, we have seen educated and uneducated individuals become increasingly concerned about the state of the economy, and everyone appears to be interested. This understanding empowers us to make informed decisions and navigate the economic landscape more effectively.

Let’s start with the basics. What exactly are interest rates? They are the cost of borrowing money. But they are not just numbers on a screen. Interest rates significantly impact the economy, and altering the rate is one of the most effective instruments for a central bank. This role of central banks in stabilizing the economy is crucial and should reassure us that there are measures in place to manage economic fluctuations. Based on monetary policy objectives, interest rates are a tool central banks use to stabilize the economy. The central bank determines the target interest rate to affect market rates, making it an important component of economic policy. Interest rates will significantly affect inventory and other investments.

According to the CBN Governor, Olayemi Cardoso, raising interest rates from 26.75% to 27.25% is to control and reduce inflation. Understanding the relationship between interest and inflation rates is critical to making informed economic decisions. Higher interest rates mean lower inflation, and vice versa. If the inflation rate exceeds the investment return rate, the actual value of the investment decreases. Inflation is a widespread increase in the price level. For example, we saw increased commodity prices, which continued to rise. The CBN Governor’s address welcomed the success of lowering inflation in August to 32.15% from 33.40% in July 2024.

Some critical questions need to be addressed to make sense of the current situation. Can we attribute the decline in inflation to increased interest rates? Many have stated that an increase in harvest caused the fall, as we are now in the harvest season. But does this mean that Nigeria’s inflation rate does not respond to increases in interest rates? What could the problem be? What other difficulties will Nigeria face due to the higher interest rate? Are there any benefits to increased interest rates in Nigeria? What are the manufacturing firms saying? What could be done better? This page provides answers to a variety of queries that people may have.

The relationship between Interest Rate and Inflation Rate in the case of Nigeria

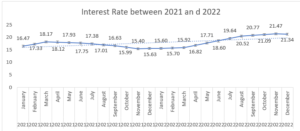

We have seen the CBN’s bold move and confidence in raising interest rates to control inflation, which we know as a monetary policy tool. The question is: is there an effect? Let’s look at trend analysis to observe how one variable affects the others.

As seen above, interest rates have been rising since 2023, and we have had no experience of them falling. According to CBN data, interest rates increased by 1% every month from January 2023 to December 2023, bringing the annual average to 18.375%. From January to August 2024, interest rates climbed by an average of 5% per month, bringing it to an average of 24.688% by the end of the eight months. What was the trend like before this time of 2023-2024?

Following the COVID-19 pandemic, the CBN raised interest rates further to reduce inflation in the economy, from 15.75% in December 2020 to 16.47% in January 2021. After increasing to 18.17% from 16.47% in February 2021, the CBN reduced the rate to promote economic growth. They continued to decrease the rate until November 2021. Nigeria has been witnessing interest rate increases since December 2021, with the most recent announcement in September 2024 of a rise to 27.25%. The CBN’s reason for boosting interest rates is to combat inflation. The critical question that needs to be answered beyond the textbook is, Has the CBN reduced inflation despite increasing interest rates?

Based on this data, we can observe that interest and inflation rates have risen over time. This data demonstrates that a negative relationship does not exist between interest rate and inflation rate in Nigeria from January 2023 up until July and August 2024. Despite the recent fall in inflation, many have stated that it is due to an abundance of food crops this season, which Mr. Governor affirmed during the press conference. Looking at the trend, it is clear that increases in interest rates have not resulted in a reduction in price increases, which is just inflation. Due to its dramatic impact, the rejection of the higher interest rate by industrial enterprises is a clear sign of the urgency for a change in monetary policy. If this approach does not work, are there alternative options for achieving monetary goals?

Interest rates are used to encourage savings while discouraging investment in the economy. People are motivated to save when interest rates rise because of the prospect of more significant returns. At the same time, businesses are discouraged from borrowing money to invest due to the higher interest to repay. With the lending rate of around 35% from most commercial banks, how will such help the country to drive production and growth from key sectors: Transportation, Healthcare, Education, Manufacturing, and Agriculture, among others? Remembering that inflation is just a lot of money spent on a small number of things is also vital. In this instance, we can claim there’s too much money in circulation. What can we say about Nigeria’s currency in circulation?

Currency in Circulation

According to the CBN’s most recent data, the money supply of M2 had grown by 63.3 percent as of August 2023. As of August 2024, it was valued at N107.18 trillion, up from N65.63 trillion the year before.

M2 is a critical measure of the total money supply in any economy. It is the accumulation of coins, cash, demand deposits, non-bank currencies, and readily convertible liquid assets. Economists, investors, and policymakers oversee a nation’s M2 data to comprehend its future economic direction and possibilities.

Raising M2 will encourage investment and economic growth, but as we have seen in Nigeria, rapid expansion also leads to inflation and financial instability. On the other hand, raising interest rates is anticipated to impede the economy by increasing the cost of borrowing and decreasing investment and consumer expenditure. At this point, Nigeria does not require this.

Does CBN have environmental consciousness? According to the data, the CBN would have noticed that firms and individuals were finding it more challenging to engage in economic activities this year if they had been aware of the situation. They must understand that in addition to the ongoing inflation, the central bank’s activities in raising interest rates and expanding the money supply have made things more unclear and volatile by scaring investors and impeding producers.

As we have seen, every time the CBN announces a policy change, they confound people by arguing that economic knowledge suggests hiking interest rates in this particular circumstance. They might be right if other conditions were met, including most enterprises having access to financing and an economy expanding quickly.

Expanding the money supply and raising interest rates are fundamentally incompatible strategies for combating inflation. It defies economic logic to simultaneously increase interest rates and the money supply, as they have divergent impacts on bonds, savings, and foreign and domestic investments.

Currency Outside the Banking System

Nigeria is an economy where money circulates far more outside banks than inside banks. In such a case, how do you want the policy to work? Let’s look at the data and trends of money in circulation and outside banks.

Why do we have so much money outside of the banking sector? What is driving this despite various policies, including the cashless policy? According to CBN data, there is a large amount of money outside banks, which is outside banks’ control. For example, in January 2023, currency in circulation was 1,386,398.50 (in a million naira), while currency outside banks was 594,214.11 (in a million naira), compared to January 2024, when the currency in circulation increased to 3,650,500.20 (in a million naira), and currency outside banks increased to 3,282,198.20. Looking at the beginning of the years, i.e., January 2023 and 2024, currency in circulation climbed by 163%, whereas currency outside banks increased by 314% during a year. Furthermore, cash in circulation has increased by 7% on average, while money outside banks has risen by 10% on average, representing a 3% increase over currency in circulation growth between January 2023 and August 2024.

What are the causes of this enormous amount of currency in circulation? We have heard many people saying that issues of kidnapping in the country are the leading cause of that and an illicit way of making money, and that is often attributed to fraudsters engaged in cybercrime. Is that the major? Beyond kidnapping as business and illegal cash in circulation, it is essential to know that the informal sector dominates Nigeria. According to NBS, informal employment accounts for 92.7% of the population and establishes that the informal sector largely dominates Nigeria. This sector is mainly financially excluded. Why? They are excluded because of a trust issue, as most people in the informal sector do not trust the banking system. Also, Nigeria is a cash-based economy, with lots of trading in the informal sector; the issue of network instability in the financial sectors has also encouraged people to keep their funds outside of the banks, and finally, there is the issue of corruption, which encouraged money laundering. How can we make economic policy work if we have all of this? It’s as if we’re waging the wrong fight and causing misery for those who aren’t involved, as in the case of crucial economic participants. As we can see, investment in the economy is declining as interest rates rise over time, and if manufacturing and other firms are not flourishing, how can Nigeria achieve its vision of moving from a consumption economy to a production economy since most basic things Nigeria uses are currently imported? If there is no radical transformation of the manufacturing sector, curbing the high unemployment and poverty rate will be nearly impossible.

Higher interest rates impact MSMEs and SMEs in Nigeria.

According to research, MSMEs employ 80% of the population and account for approximately 46.3% of GDP. Micro Enterprises (ME) in Nigeria accounted for 96.9% of overall business activity, while SMEs accounted for 3.1%. As of 2020, MSMEs accounted for over 46.3% of national GDP, 6.21% of gross exports, and employed more than 84% of the workforce. Compared to other countries, Malaysia’s MSMES employs 48% of the population, contributes 38.2% of GDP, and accounts for 97.2% of enterprise. Furthermore, MSMEs in South Africa account for 98.5% of the business sector, 40% of GDP, and 60% of total employment[1].

MSMEs and SMEs play significant roles in transforming a nation’s economic success; most growth will stall when lending rates become exorbitant. Creating an enabling environment for MSMEs and large businesses is crucial. However, there must be a deliberate attempt to create an enabling environment that considers the peculiarities of MSMEs. Despite this vital function, Nigeria’s macroeconomic climate continues to be a hindrance. Over the years, much discussion has been concerning access to finance, but what has been done? Maybe nothing significant because the problem still exists.

As previously stated, higher interest rates discourage borrowing, which deters investment. If investment is low, how do we create job opportunities in Nigeria despite its high unemployment rate? According to the NBS, the unemployment rate rose to 5.3% in the first quarter of 2024. Many people became perplexed by these statistics, wondering what the data meant and what the reality of the economy showed. Some think it’s great that the unemployment rate isn’t two digits. The truth is that informal unemployment is 92.7% as of Q1 2024, according to NBS[2]. This represents an economy dominated by the informal sector. To address the issue of unemployment, it is critical to rely on job providers, as evidenced by data from MSMEs and SMEs. They are essential to our economic development, and a conducive climate must be created for them to thrive.

Some professionals feel that higher interest rates are favorable for investing. When comparing portfolio investment to foreign direct investment, it is worth noting that portfolio investors relocate their funds to areas with higher interest rates, whereas foreign direct investors do the opposite. Why is that? More considerable interest rates indicate more significant rewards for investors. Direct investment is discouraged since rising interest rates increase the cost of borrowing. What is essential to understand is that portfolio investment reduces access to funding for individuals seeking to make physical investments such as establishing plants. Yes, portfolio investing is critical to the economy because it reduces the problem of a lack of access to finance. Still, regulatory authorities must ensure that the rate is both appealing to portfolio investors and those looking to borrow to invest.

To summarize, regulatory authorities must maintain an equilibrium between the two. Nigeria’s current macroeconomic situation could be more stable and encouraging to investors on both sides of the investment equation. For example, increasing inflation reduces the return-on-investment value, discouraging portfolio investors.

Next Steps for Policymakers?

This insight highlights the importance of fighting the actual fight. CBN efforts may be futile if they do not discover a way to solve currency problems outside banks and stop making counterproductive policies. CBN needs to be aware of what is happening around them and stop making the economy look bad for businesses and the people. It is impossible to simultaneously increase the money supply and interest rate and expect positive results. At this time, we must stop pumping money into the economy. CBN must work strictly on this to achieve its price stability mandate. Also, it is only possible to control what you have authority over. The percentage of money that is not in a bank is enormous, and the current CBN policy may not achieve anything significant while making those who are not responsible bear the brunt and cripple the income. We must bring funds from outside banks back into the banking system. To achieve that, we must advance financial inclusion and provide underprivileged communities with access to banking; we must first broaden the use of Fintech solutions. Since dependable connectivity is essential to the success of digital financial services, investments in telecommunications infrastructure are necessary to guarantee a steady network. Increasing the strength of cybersecurity measures is also crucial because fraud and network assaults have historically left numerous fintech companies bankrupt. Finally, to avoid fraud and foster the development of financial technology, regulatory frameworks must strengthen regulation without stifling innovation. By taking these actions, more people will be encouraged to keep their money in the banking system by increasing convenience and trust.

Tracking and recovering these funds is crucial in combating illicit money in circulation, with the EFCC playing a pivotal role in this process. The aim of rigorous monitoring methods should be to prevent the accumulation of wealth in the hands of a few. Revisiting Nigeria’s cashless policy, investing in technology, and implementing e-government at all levels are vital measures to reduce corruption and increase the amount of money in the banking system.

Addressing the foreign exchange market’s volatility is also necessary. The amount of money Naira used to buy foreign currency should be limited to prevent the wealthy from buying dollars with cash. It’s critical to revisit specific Emefiele-era initiatives, emphasizing improvement over disapproval.

The Ministry of Finance ensures governors appropriately spend money from state and local governments. Close coordination between the Ministry of Finance and the CBN is crucial to address these issues, as is accountability at all governmental levels. This will instill a sense of transparency and responsibility in the financial system.

Last but not least, sustainable solutions necessitate cooperation between the public and private sectors and data-driven decision-making. The public-private sector must collaborate for joint infrastructure projects, such as co-funding digital payment systems and cybersecurity frameworks, which leverage private innovation and government oversight. This partnership strengthens financial systems, promoting security and inclusion. All parties involved must work toward economic stability; we must solve these issues and guarantee a more secure future for Nigeria.

In conclusion.

It is difficult to fight a battle you do not understand and win. We must return to the fundamental source of these crises and fight the actual battles. It is enough to continue damaging the economy and causing businesses and citizens to suffer while fighting the wrong fight. If the CBN keeps increasing the money supply (M2) and fails to bring back or reduce money outside the bank, inflation will persist. At the same time, interest rates remain high, causing businesses to fail and unemployment to rise. Looking for a long-term solution to help companies and people flourish is crucial. Therefore, we must all come together to achieve economic stability. Nigeria is our country, and we can’t afford her to fail. Let us walk the talk!