Every country has its fair share of man-made problems but sometimes, ironically, we find it difficult to explain why simple problems look so insurmountable. Societal problems are best addressed with strong value orientation and a misalignment in values at the leadership level is usually a set back for national development. Man-made problems no matter how complex are never insurmountable after all where there is a will there’s a way. Beyond willingness is the need for value alignment otherwise leadership begins to work at cross purpose.

Nigeria as a country is confronted with different man-made challenges. Talk of poor infrastructure, corruption, insecurity, bad governance, poor health and medical infrastructure. Why do the problems seem intractable, is it lack of willingness or poor vision and value alignment at various levels of political leadership?

Recently and precisely at 8:37am I drove to Marina, the central business district of Lagos and I was delighted to observe a good idea at work. Thrilled to observe new thinking and new ways of thinking regarding solving some of the problems that seem intractable. I saw that Sterling Bank Head Office is being given a creative facelift by covering its head office building with solar panels with a view to generate electricity for its buildings and adjourning buildings. The Bank Plc has blazed the trail as the first African corporate organization to power its headquarters with the Building Integrated Photovoltaic (BIPV) energy technology as its primary source of energy.

What makes the idea novel and what insight is there for leadership?

Creative Leadership at Sterling Bank

There are various forms of leadership, however regardless of the size of the institution, the way of now and the future is to firmly entrench creative leadership at every level of the organization. It takes a creative mind to recognize problems and do something about them. It takes a creative mind to turn wasting assets into beneficial resources. Creative minds do not sulk about the problem, they get up to do something about it. The MD/CEO of Sterling Bank Abubakar Suleiman deserves an accolade for successfully leading the bank to move beyond conventional thinking to a creative problem solving approach. The bank has become a pacesetter in its resolve to vigorously pursue its vision of concentrating investment under its HEART of Sterling program. The HEART is an acronym for investment priorities that can impact the economy remarkably, Health, Education, Agriculture, Renewable Energy and Transportation (HEART). Why is the HEART strategy of Sterling Bank of Strategic importance? Poor education has a linkage to the society’s capacity to develop skills required to solve its problems, provides jobs for the youth and minimizes the level of insecurity. Without a sound healthcare system, the nation’s ability to become highly productive becomes questionable. Nigerian’s average lifespan is current 61years old, many citizens are cut down in their prime because they lack access to quality healthcare, a deliberate investment in the healthcare sector can transform this situation.

The power of vision and Value alignment

Many institutions today, have lost their potentials to unnecessary turf war occasioned by misalignment in vision and values. To achieve transformational change, leaders must be skilled in developing a compelling vision and support it with the resolve (willingness) to make it happen. Compelling vision can be very inspirational for people and drive them towards shared value. When leaders take self-interest out of their agenda, their vision becomes sellable. Sterling Bank HEART program goes beyond the traditional thinking of the Nigerian financial institution. The HEART program of Sterling Bank comes with a strong value proposition to drive positive social change. The bank chose to play in the less attractive market, a good student of management knows that disruptive innovators are known to play in unserved and underserved markets. Why is the Sterling bank HEART Program of critical importance to our national development? According to the CBN report published in the Nigerian Tribune:

“Nigerians spent a total of $39.66bn on foreign education and healthcare-related services between 2010 and 2020, according to the central bank of Nigeria data. According to CBN’s balance of payments, Nigerian parents and guardians paid about $28.65bn for their wards to study abroad during the period under review. The bop report also revealed that Nigerians paid $11.01bn for healthcare-related services in foreign countries”

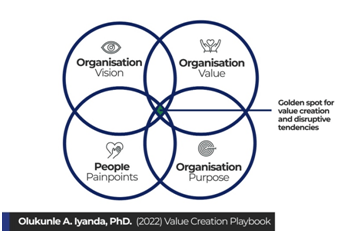

To be relevant in this age of complexities and uncertainties, organizations can create value by creating solutions where people hurt the most. When organization connect people’s pains and need to its vision, miracle happens and strong value is created.

A strong focus on people’s pain points, done correctly is a gamechanger for any leader, be it political or corporate. With the HEART program the leadership of the bank has proven that it is putting its mouth where the money is, by bringing alignment in vision, value and purpose, a sterling example to emulate.

Sterling bank HEART Program and National development.

Sterling bank strategy of opening a new playbook in critical sector of the economy facilitate radical change in the fortune for the real sector and empower the MSME to quadruple their present contribution to the economy.

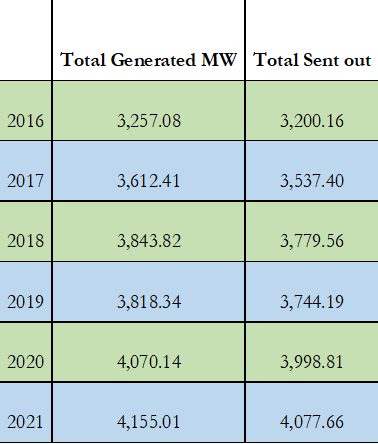

Let’s begin with power, Nigeria power generation capability is abysmally low, the question is why big enterprise in the service sector for instance should depend on the national grid if they can make use of alternative energy. In the table below, between 2016 and 2021, Nigeria managed to generate a maximum of 4155:00MW to a population of over 200million.

Total Electricity Generated from the Gencos 2016-2021

Total Electricity Generated from the Gencos 2016-2021

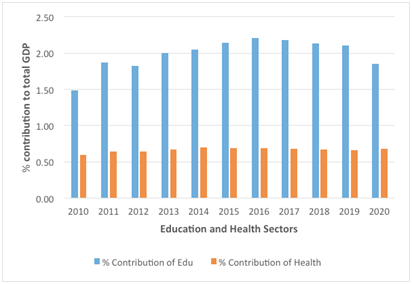

Percentage Contribution of Health and Education Sectors to the Economy

From the above table and chart, Education, healthcare, agriculture, transportation, and Energy are gold mine for investment, a look at the contribution of Education and Health sector to national GDP is terribly low, investment into those sectors is an investment in the future of the country. With rising levels of disposable income among some segments of society, there is a greater demand for private coverage. Public hospitals are overstretched and under-funded, which drives down quality and lowers standards. Therefore, more investment in private hospitals which provide patients with a faster, more effective option abound. Again, the lack of manpower due to massive brain drain in the sector opens up the space to (capital) technology intensive intervention rather than labor intensive one. The deployment of mHealth, Telemedicine and Al facilities hold a lot of promise for the future, in compensating for the shortage in manpower. Again, Sterling Bank Playbook is a pacesetter for aggressive national development.

sense’.

Olukunle A. Iyanda PhD, FCA, SNFLI.

Founder/CEO, BROOT Consulting Nigeria Limited.

Human-Centric Design Led Innovation Consultant.